- Home

- About Us

-

Products

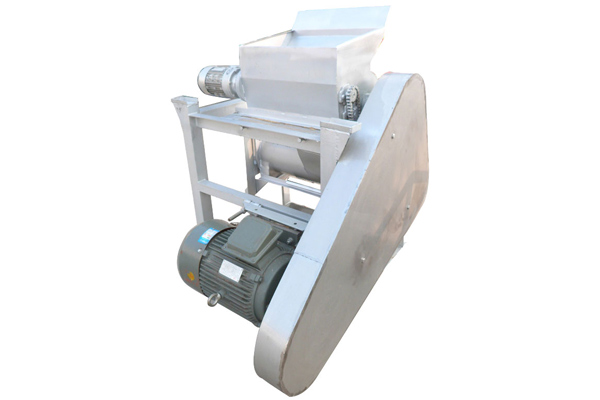

- Cassava Crusher

- Cassava Sieving Machine

- Cassava Washing Machine

- Dewatering and Drying System

- Cassava Peeling Machine

- Cassava Grinding Machine

- Cassava Chips Cutting Machine

- Cassava Drying Machine

- Cassava Garri Fryer

- Potato Washing Machine

- Cassava Flour Milling Machine

- Cassava Harvesting Machine

- Cassava Starch Extraction Machine

- Case

- News

- Service & Parts

- Contact Us

EN

EN

fr

fr  es

es  it

it  pt

pt